Paul Krugman

October 26, 2010, 1:15 am

Do Investors Expect Too Much From Bernanke?

The 5-year TIPS spread

The 5-year TIPS spreadFinancial markets seem convinced that quantitative easing will be highly effective at solving at least one problem: inflation running well below the Fed’s 2-percent-or-so target. The chart above shows the difference between interest rates on 5-year inflation-protected bonds (which are

now negative) and rates on unprotected bonds; implicitly, the market forecast of inflation over the next five years has risen half a point.

But I really don’t understand this. Granted that QE2 will probably have some positive effect, hopefully bigger than analysis based on the

debt-maturity equivalence suggests. Still, the prospect remains that we’ll face multiple years of high unemployment — or, if you prefer, a

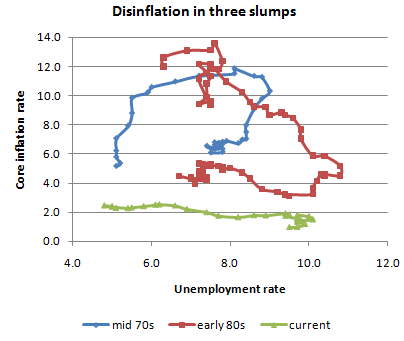

protracted large output gap (PLOG). And history is clear on what that means:

declining inflation:

My guess, then, is that the markets are overreacting; they’re thinking, “The Fed is printing money!”, while forgetting that this ultimately matters, even for inflation, only to the extent that it seriously reduces unemployment.

Source:

Paul Krugman The Conscience of a Liberal NYT blog

No comments:

Post a Comment