March 31 (Bloomberg) -- Greece plans to sell a global bond in dollars in the next two months as part of a plan to raise 11.6 billion euros ($15.6 billion) in funding by the end of May after investors lost money on its most recent sale.

Greece needs to borrow a total of 32 billion euros this year, including May’s amount, Petros Christodoulou, director general of the Public Debt Management Agency, said today in a Bloomberg Television interview. He declined to say how big the dollar issue might be. It may be between $5 billion and $10 billion, the Wall Street Journal reported, citing a Greek government official it declined to name...--

Full text

Comment: Financial markets always go for the weakest, and among the many weak sovereign debtors, Greece is one of the weakest. There's the smell of rotten prey in the air.

Wednesday, March 31, 2010

Malinvestment

From the LATimes:"... Vacant homes are sprinkled throughout Willowalk, betrayed by foot-high grass. Others are rented, including some to families that use government Section 8 vouchers to live in homes with granite countertops and vaulted ceilings.When the development opened in 2006, buyers were drawn to the area by advertising describing it as a "gated lakeshore community." Now, many in Hemet call Willowalk the "gated ghetto," said John Occhi, a local real estate agent.There are dozens of places like Willowalk, and they are turning into America's newest slums, says Christopher Leinberger, a visiting fellow at the Brookings Institution. With home values at a fraction of their peak, he said, it no longer makes sense to live so far from the commercial centers where jobs are concentrated.

"We built too much of the wrong product in the wrong locations," Leinberger said...--

Full text

Backgrounder: The Stimulus Scam

"We built too much of the wrong product in the wrong locations," Leinberger said...--

Full text

Backgrounder: The Stimulus Scam

Tuesday, March 30, 2010

More than one Greece

California, New York and other states are showing many of the same signs of debt overload that recently took Greece to the brink -- budgets that will not balance, accounting that masks debt, the use of derivatives to plug holes, and armies of retired public workers who are counting on benefits that are proving harder and harder to pay. --

Full text

Comment: Living on borrowed money is coming to an end. The problem runs deeper than the article says. The heart of matter is the modern system of a dysfunctional democracy due to the popular adulation of the state.

Sell-off in US-Treasuries

The yield on 10-year Treasuries – the benchmark price of global capital – surged 30 basis points in just two days last week to over 3.9pc, the highest level since the Lehman crisis.

Sell-off in US Treasuries raises sovereign debt fears - Investors are braced for a further sell-off in US Treasuries after dramatic moves last week raised fears that the surfeit of US government debt is starting to saturate bond markets....

Looming over everything is the worry that markets will not be able to absorb the glut of US debt as the Fed winds down its policy of bond purchases, starting with an exit from mortgage-backed securities. It currently holds a quarter of the $5 trillion of the MBS market...

Full text

Comment: The greatest bubble the world has ever seen is about to burst.

Sell-off in US Treasuries raises sovereign debt fears - Investors are braced for a further sell-off in US Treasuries after dramatic moves last week raised fears that the surfeit of US government debt is starting to saturate bond markets....

Looming over everything is the worry that markets will not be able to absorb the glut of US debt as the Fed winds down its policy of bond purchases, starting with an exit from mortgage-backed securities. It currently holds a quarter of the $5 trillion of the MBS market...

Full text

Comment: The greatest bubble the world has ever seen is about to burst.

Monday, March 29, 2010

Bridges to nowhere

March 30 (Bloomberg) -- Japan’s industrial production retreated in February, snapping an 11-month winning streak that helped to secure a recovery from the country’s worst postwar recession.

Factoryoutput declined 0.9 percent from January, when it rose 2.7 percent, the most in eight months, the Trade Ministry said today in Tokyo. The median estimate of 24 economists surveyed by Bloomberg News was for a 0.5 percent drop.

Full text

Comment: After trillions spent in useless stimulus packages, nothing has been gained other than a Japanese state that is so much in debt that a recovery has become almost impossible. Watch out, in the US and Europe we are on the same path.

Factoryoutput declined 0.9 percent from January, when it rose 2.7 percent, the most in eight months, the Trade Ministry said today in Tokyo. The median estimate of 24 economists surveyed by Bloomberg News was for a 0.5 percent drop.

Full text

Comment: After trillions spent in useless stimulus packages, nothing has been gained other than a Japanese state that is so much in debt that a recovery has become almost impossible. Watch out, in the US and Europe we are on the same path.

A look at the euro bears

March 29 (Bloomberg) "...futures traders are more optimistic on the greenback than any time since 1999, the year the European Union’s shared currency was introduced. Hedge funds and other large speculators had 74,917 more wagers the dollar would rise than contracts that profit from it falling as of March 23, the widest gap on record, Commodity Futures Trading Commission data show...

Full text

Comment: It's good to see that a huge short position against the euro is in place.

Full text

Comment: It's good to see that a huge short position against the euro is in place.

The beginning of the beginning of the bond market's long decline

March 29 (Bloomberg) -- Former Federal Reserve Chairman Alan Greenspan’s warning that rising yields on government debt will drive up American borrowing costs is resonating with the world’s biggest bond traders, who say this month’s losses in the market for U.S. Treasuries are just the beginning.--

Full text

Comment: We've been expecting this to happen for quite some time. Finally, bonds have begun their long decline. Greenspan fired the starting shot.

The implications of the bond disaster will be tremendous. Watching how one's pension fund goes up in smoke is only part of the story.

Full text

Comment: We've been expecting this to happen for quite some time. Finally, bonds have begun their long decline. Greenspan fired the starting shot.

The implications of the bond disaster will be tremendous. Watching how one's pension fund goes up in smoke is only part of the story.

RGE Strategy Flash: Implications of the EMU/IMF Greece Deal

- On March 25, the Heads of State of the Eurozone reached an agreement on the principles for emergency lending to sovereign states in the single currency area in the event of a state failing to raise funds in the capital markets. The agreement represents a victory for the German chancellor who—faced with fierce domestic opposition to any bailout of Greece—pushed for an IMF involvement against the prevailing consensus among the heads of the ECB, the Eurogroup and the EU Commission. While no numbers were released in the statement, the details of the fiscal “support” package with respect of Greece imply a majority EMU-financed joint EMU/IMF package. Specifically, there appears to be €22 billion in financing with the zone members providing about €15 billion of that amount, according to their ECB capital key, and the IMF the rest. RGE considers the current deal to be mixed for a number of reasons. Click Here For Full Analysis

Sunday, March 28, 2010

Euro recovery gains strength

March 29 (Bloomberg) -- The euro strengthened against the dollar for a second day on receding concern Greece’s financial crisis will derail the 16-nation region’s economic recovery...

The euro advanced before a report today forecast to show European economic confidence rose to the highest since June 2008 and builds on gains last week after the European Union and International Monetary Fund pledged to help Greece finance its budget deficit...--

Full text

Comment: No surprise to the readers of this blog.

The euro advanced before a report today forecast to show European economic confidence rose to the highest since June 2008 and builds on gains last week after the European Union and International Monetary Fund pledged to help Greece finance its budget deficit...--

Full text

Comment: No surprise to the readers of this blog.

Friday, March 26, 2010

Some afterthoughts on the Greek crisis

Those of you who have read my comments might remember that I was pretty much sure that in the end the euros will come to a conclusion. This is the way a great project works. The AGENDA of the euro is so big that the disputes about certain actions are only minor disputes. The GREATER AIM overwhelmes everything else and in the end, some kind of compromise, some kind of conclusion will be achieved. I was sure of that. Indeed, the euro project works very strange, very different from a declining project. Could it be that those who look at the euro from the outside look at it from the perspective of their own decline? Could it be that the euros aren't bothered by that because they know that in the end they will be on the winning side? Well, nobody knows, and all I can give is thoughts for reflection. I know that I am pretty much alone in this assesssment. Sorry for that, but I can do no other.

Greek tragedy ends with happy end

March 26 (Bloomberg) -- The euro rose from a 10-month low against the dollar a day after European leaders endorsed a Franco-German proposal to assist Greece through a mix of International Monetary Fund and bilateral loans.

Full text

Comment: This Greek episode indeed may have ended with a happy end, but for many countries around the world the great debt tragedy is still only in its early stages. More to come. With hardly a happy end in the end.

See assessment in major papers

Full text

Comment: This Greek episode indeed may have ended with a happy end, but for many countries around the world the great debt tragedy is still only in its early stages. More to come. With hardly a happy end in the end.

See assessment in major papers

Thursday, March 25, 2010

Forget about global warming...

... the real threat is the disappearance of the honeybee:

AP "... MERCED, Calif. – The mysterious 4-year-old crisis of disappearing honeybees is deepening. A quick federal survey indicates a heavy bee die-off this winter, while a new study shows honeybees' pollen and hives laden with pesticides..."

Full text

Comment: No more food in the line.

AP "... MERCED, Calif. – The mysterious 4-year-old crisis of disappearing honeybees is deepening. A quick federal survey indicates a heavy bee die-off this winter, while a new study shows honeybees' pollen and hives laden with pesticides..."

Full text

Comment: No more food in the line.

No news to readers of this blog

March 26 (Bloomberg) -- The euro rebounded from a 10-month low versus the dollar after European Central Bank President Jean-Claude Trichet said he welcomed a European Union agreement on an aid plan for Greece. Europe’s currency gained against 14 of its 16 major counterparts ...--

Full text

Comment: I'm getting tired of saying "I told you so". Yet this feat is not due to any superiority of mine. The fact that I am so often right in a sea of nonsense is a consequence of the sad problem that so many analysts and commentators are outright dumb, including not only one among the holders of the Nobel prize in economics. Sadly so.

Full text

Comment: I'm getting tired of saying "I told you so". Yet this feat is not due to any superiority of mine. The fact that I am so often right in a sea of nonsense is a consequence of the sad problem that so many analysts and commentators are outright dumb, including not only one among the holders of the Nobel prize in economics. Sadly so.

Too much supply of bad debt

WSJ - NEW YORK—Treasury prices fell hard after a poor five-year auction that escalated concerns about the government's ability to sell its massive amounts of debt.

Worries about supply picked up this week after the government's $44 billion two-year auction on Tuesday attracted less demand than anticipated. The five year sale was messier, sending Treasury prices tumbling. Demand at the auctions may have been impacted by less buying from Japan as its fiscal year-end approaches. Nonetheless, the poor results put investors on edge given the huge amounts of debt the government is likely to continue to issue to fund its budget deficit...

Full text

Comment: As we are just at the beginning of the great wave of supply, it takes little thought to foresee further price declines ahead for bonds.

Worries about supply picked up this week after the government's $44 billion two-year auction on Tuesday attracted less demand than anticipated. The five year sale was messier, sending Treasury prices tumbling. Demand at the auctions may have been impacted by less buying from Japan as its fiscal year-end approaches. Nonetheless, the poor results put investors on edge given the huge amounts of debt the government is likely to continue to issue to fund its budget deficit...

Full text

Comment: As we are just at the beginning of the great wave of supply, it takes little thought to foresee further price declines ahead for bonds.

Wednesday, March 24, 2010

Dollar risk versus euro risk

WSJ MICHAEL CASEY

NEW YORK -- Something troubling has occurred in the market for default protection on the debt of the world's biggest borrower. As the folks at Standard Poor's Valuation and Risk Strategies division noted in a research note Monday, the difference between the spread on U.S. sovereign credit default swaps and an equivalent benchmark for AAA-rated euro-zone sovereigns flipped into positive territory March 12. As U.S. CDS spreads expanded to their widest levels in two years, that cross-region gap blew out to 5.7 basis points last Friday before narrowing to 4.7 Tuesday.

Wider CDS spreads indicate that sellers of insurance against a particular issuer's default are charging more for it. In effect, the positive U.S.-versus-euro zone spread means investors think the risk of a U.S. default--however remote--is greater than that on euro-denominated sovereign debt...."

Full text

Comment: The run-up to default takes place as an exponential curve. Once "the bent" is taken, the run-up to bankruptcy accelerates.

NEW YORK -- Something troubling has occurred in the market for default protection on the debt of the world's biggest borrower. As the folks at Standard Poor's Valuation and Risk Strategies division noted in a research note Monday, the difference between the spread on U.S. sovereign credit default swaps and an equivalent benchmark for AAA-rated euro-zone sovereigns flipped into positive territory March 12. As U.S. CDS spreads expanded to their widest levels in two years, that cross-region gap blew out to 5.7 basis points last Friday before narrowing to 4.7 Tuesday.

Wider CDS spreads indicate that sellers of insurance against a particular issuer's default are charging more for it. In effect, the positive U.S.-versus-euro zone spread means investors think the risk of a U.S. default--however remote--is greater than that on euro-denominated sovereign debt...."

Full text

Comment: The run-up to default takes place as an exponential curve. Once "the bent" is taken, the run-up to bankruptcy accelerates.

Twilight of the Gods for bonds

NEW YORK (Reuters) - Stocks fell on Wednesday as Portugal's credit rating downgrade and a weak Treasury note auction stirred concerns about sovereign debt...

Full text

Comment: It is not only Greece or Portugal that are close to bankruptcy. For many other governments, not only of the PIIGS, the same fate looms at the horizon. All it takes to bring the debt pyramid down is a slight increase in interest rates as the result of rising inflation rates or even only their expectation.

Full text

Comment: It is not only Greece or Portugal that are close to bankruptcy. For many other governments, not only of the PIIGS, the same fate looms at the horizon. All it takes to bring the debt pyramid down is a slight increase in interest rates as the result of rising inflation rates or even only their expectation.

Gary North has seen the future ...

... and it looks like Detroit:

"... To understand what is going to happen to America's health care delivery system, we must first understand what has happened to Detroit.

Detroit is dying. Yes, I know that there are lots of books on "The Death of. . . ." That word sells books. But Detroit really is dying. It is the first metropolis in the United States to be facing extinction. We have never seen anything like this in American history. It is happening under our noses, but the media refuse to discuss it. To do so would be politically incorrect. Two factors tell us that Detroit is dying. The first is the departure of 900,000 people – over half the city's population – since 1950. It peaked at 1.8 million in 1950. It is down to about 900,000 today.

In 1994, the median sales price of a house in Detroit was about $41,000. The housing bubble pushed it up to about $98,000 in 2003. In March 2009, the price was $13,600. Today, the price is $7,000. Check the price chart..

Read more

Comment: When will we finally wake up to the obvious: social policy is a destructive force. It not only destroys the economy but along with that it destroys families and the rest that has been left of a moral conscience.

"... To understand what is going to happen to America's health care delivery system, we must first understand what has happened to Detroit.

Detroit is dying. Yes, I know that there are lots of books on "The Death of. . . ." That word sells books. But Detroit really is dying. It is the first metropolis in the United States to be facing extinction. We have never seen anything like this in American history. It is happening under our noses, but the media refuse to discuss it. To do so would be politically incorrect. Two factors tell us that Detroit is dying. The first is the departure of 900,000 people – over half the city's population – since 1950. It peaked at 1.8 million in 1950. It is down to about 900,000 today.

In 1994, the median sales price of a house in Detroit was about $41,000. The housing bubble pushed it up to about $98,000 in 2003. In March 2009, the price was $13,600. Today, the price is $7,000. Check the price chart..

Read more

Comment: When will we finally wake up to the obvious: social policy is a destructive force. It not only destroys the economy but along with that it destroys families and the rest that has been left of a moral conscience.

Tuesday, March 23, 2010

The euro in crisis

To get a full picture of what is going on, watch the video presentation by Antony Mueller about the structure of the European Union and the "laws" that determine the "independence" of the European Central Bank:

http://www.newmedia.ufm.edu/gsm/index.php?title=Independence_of_the_European_Central_Bank

http://www.newmedia.ufm.edu/gsm/index.php?title=Independence_of_the_European_Central_Bank

Don't bank on it

March 23 (Bloomberg) -- The dollar rose toward a three-week high against the euro amid speculation European Union leaders will fail to agree on an aid package for Greece at a summit this week, stoking demand for the U.S. currency as a refuge...--

full text

Comment: The noise about the bailout of Greece has been mainly directed at the rest of the PIGS to put their house in order and to avoid being put to shame the same way as it has happened with Greece. I'm pretty much sure that there will be a kind of bailout agreement for Greece and that the threats of letting Greece go bankrupt has been helpful to mobilize the political and popular will in the rest of Europe to bring public debt under control.

full text

Comment: The noise about the bailout of Greece has been mainly directed at the rest of the PIGS to put their house in order and to avoid being put to shame the same way as it has happened with Greece. I'm pretty much sure that there will be a kind of bailout agreement for Greece and that the threats of letting Greece go bankrupt has been helpful to mobilize the political and popular will in the rest of Europe to bring public debt under control.

Monday, March 22, 2010

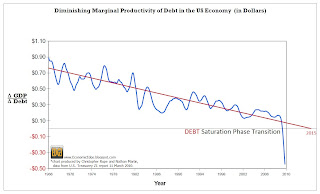

Below the point of debt saturation

Nathan Martin writes:

"...Back in the early 1960s a dollar of new debt added almost a dollar to the nation’s output of goods and services. As more debt enters the system the productivity gained by new debt diminishes. This produced a path that was following a diminishing line targeting ZERO in the year 2015. This meant that we could expect that each new dollar of debt added in the year 2015 would add NOTHING to our productivity..."

Read full text.

Comment: This trend is well known. It was mainly the late Richebächer who used this statistics for his predictions that debt expansion will not bring about swift recoveries. For the current situation the chart above (click to enlarge) says that the stimulus money will be a gigantic waste with negative effects on the economy.

"...Back in the early 1960s a dollar of new debt added almost a dollar to the nation’s output of goods and services. As more debt enters the system the productivity gained by new debt diminishes. This produced a path that was following a diminishing line targeting ZERO in the year 2015. This meant that we could expect that each new dollar of debt added in the year 2015 would add NOTHING to our productivity..."

Read full text.

Comment: This trend is well known. It was mainly the late Richebächer who used this statistics for his predictions that debt expansion will not bring about swift recoveries. For the current situation the chart above (click to enlarge) says that the stimulus money will be a gigantic waste with negative effects on the economy.

Economic dominoes

US States fall into contraction one after the other like dominoes brought down by excessive debt loads.

Bob Herbert from the New York Times writes:

"A story that is not getting nearly enough attention is the ruinous fiscal meltdown occurring in state after state, all across the country. Taxes are being raised. Draconian cuts in services are being made. Public employees are being fired. The tissue-thin national economic recovery is being undermined. And in many cases, the most vulnerable populations — the sick, the elderly, the young and the poor — are getting badly hurt..."

Read more about how States are forced to cut spending.

Comment: Question - "Stimulus where is thy sting?"

Backgrounder: Antony Mueller: The Stimulus Scam

Bob Herbert from the New York Times writes:

"A story that is not getting nearly enough attention is the ruinous fiscal meltdown occurring in state after state, all across the country. Taxes are being raised. Draconian cuts in services are being made. Public employees are being fired. The tissue-thin national economic recovery is being undermined. And in many cases, the most vulnerable populations — the sick, the elderly, the young and the poor — are getting badly hurt..."

Read more about how States are forced to cut spending.

Comment: Question - "Stimulus where is thy sting?"

Backgrounder: Antony Mueller: The Stimulus Scam

Thursday, March 18, 2010

China's salto mortale: back into poverty

"Guojin Mintui" - the state moves forward - the private economy shrinks.

China experiences the comeback of central planning and the end of red capitalism.

Forget about China as the next superpower, forget about China as the next economic power house. Prepare yourself to think about China again in the categories of poverty, misery, and suppression.

Article

China experiences the comeback of central planning and the end of red capitalism.

Forget about China as the next superpower, forget about China as the next economic power house. Prepare yourself to think about China again in the categories of poverty, misery, and suppression.

Article

Monday, March 15, 2010

After Krugman and Schumer, it is now ...

Ambrose Evans-Pritchard who gets it all wrong in his article:

"Is China's Politburo spoiling for a showdown with America?"

The long-simmering clash between the world's two great powers is coming to a head, with dangerous implications for the international system.

Read text

Comment: Ambrose is a hilarious writer. He suffers from the Churchillian disease of being consumed by the brilliant phrase. Half-baked thoughts in glamorous prose; as such they are always the attraction of the masses, well-educated and not-so-well educated. Yet like in real life, in politics, too, words are facts, and whole generation on all fronts were drawn into nihilation by the seduction of the sounds. I recommend to avoid reading Ambrose. His prose is dangerous and may be hazardous to your mind. In contrast to Ambrose, Krugman's writngs present no danger - on the contrary. The more one reads Krugman, the more any intelligent person will notice his garbage.

"Is China's Politburo spoiling for a showdown with America?"

The long-simmering clash between the world's two great powers is coming to a head, with dangerous implications for the international system.

Read text

Comment: Ambrose is a hilarious writer. He suffers from the Churchillian disease of being consumed by the brilliant phrase. Half-baked thoughts in glamorous prose; as such they are always the attraction of the masses, well-educated and not-so-well educated. Yet like in real life, in politics, too, words are facts, and whole generation on all fronts were drawn into nihilation by the seduction of the sounds. I recommend to avoid reading Ambrose. His prose is dangerous and may be hazardous to your mind. In contrast to Ambrose, Krugman's writngs present no danger - on the contrary. The more one reads Krugman, the more any intelligent person will notice his garbage.

Krugman gets it wrong again

Krugman: It's America That Has China Over A Barrel, Let's Take Advantage Of it

Read more

Comment: It would not be the first time that Paul Krugman gets it all wrong. Yet this time the stakes are immense. In the meantime NY senator Schumer is already on his way to follow Krugman's silly advice and prepares a bill to put tariffs on Chinese goods. What a foolish behavior! The punishment for the US would be immense. If Krugman's advice should be followed and if Schumer should succeed in challenging the Chinese, the consequence would be no less than a new crash of the US financial markets, rising inflation and a collapse of the dollar along with rising interest -- all of which would impact the real economy and make sure that recession would get longer and extend into depression.

Read more

Comment: It would not be the first time that Paul Krugman gets it all wrong. Yet this time the stakes are immense. In the meantime NY senator Schumer is already on his way to follow Krugman's silly advice and prepares a bill to put tariffs on Chinese goods. What a foolish behavior! The punishment for the US would be immense. If Krugman's advice should be followed and if Schumer should succeed in challenging the Chinese, the consequence would be no less than a new crash of the US financial markets, rising inflation and a collapse of the dollar along with rising interest -- all of which would impact the real economy and make sure that recession would get longer and extend into depression.

Sunday, March 14, 2010

Game over

By STEPHEN OHLEMACHER, Associated Press Writer Stephen Ohlemacher, Associated Press Writer

PARKERSBURG, W.Va. – The retirement nest egg of an entire generation is stashed away in this small town along the Ohio River: $2.5 trillion in IOUs from the federal government, payable to the Social Security Administration.

It's time to start cashing them in.

For more than two decades, Social Security collected more money in payroll taxes than it paid out in benefits — billions more each year.

Not anymore. This year, for the first time since the 1980s, when Congress last overhauled Social Security, the retirement program is projected to pay out more in benefits than it collects in taxes — nearly $29 billion more.

Read full text

Comment: It is a complete illusion to believe that somewhere the money paid into social security is "stashed away". The simple truth is that collectively we always live from what is CURRENTLY produced.

Backgrounder: Will Savings Save US?

PARKERSBURG, W.Va. – The retirement nest egg of an entire generation is stashed away in this small town along the Ohio River: $2.5 trillion in IOUs from the federal government, payable to the Social Security Administration.

It's time to start cashing them in.

For more than two decades, Social Security collected more money in payroll taxes than it paid out in benefits — billions more each year.

Not anymore. This year, for the first time since the 1980s, when Congress last overhauled Social Security, the retirement program is projected to pay out more in benefits than it collects in taxes — nearly $29 billion more.

Read full text

Comment: It is a complete illusion to believe that somewhere the money paid into social security is "stashed away". The simple truth is that collectively we always live from what is CURRENTLY produced.

Backgrounder: Will Savings Save US?

Saturday, March 13, 2010

Recession will go on

Robert Higgs observes: "Gross private domestic investment peaked in 2006. Between the first quarter of that year and the second quarter of 2009, it fell precipitously, by nearly 34%.

During the second half of 2009, investment spending increased by only 10%, so that late last year it was still (when measured at an annual rate) running 29% below its early 2006 level.

This huge decline in investment spending portends an extended period of slow economic growth, lasting several years and perhaps longer. Worn-out equipment, obsolete software, ill-maintained structures and depleted inventories are not the stuff of which rapid, sustained economic growth is made...

Read more

Comment: Subdued private investment, exorbitant fiscal deficits, and regime uncertainty represent a combination of factors that will reduce the the productive capacity of the economy while at the same time consumption demand and government demand holds up. Given that Obama may nominate Yellen as the next Fed's vice chairman and that thus Bernanke will get more support to his low interest rate policy, one can be as sure as one can be sure regarding economic matters that the US is running at full speed into hyperinflation.

During the second half of 2009, investment spending increased by only 10%, so that late last year it was still (when measured at an annual rate) running 29% below its early 2006 level.

This huge decline in investment spending portends an extended period of slow economic growth, lasting several years and perhaps longer. Worn-out equipment, obsolete software, ill-maintained structures and depleted inventories are not the stuff of which rapid, sustained economic growth is made...

Read more

Comment: Subdued private investment, exorbitant fiscal deficits, and regime uncertainty represent a combination of factors that will reduce the the productive capacity of the economy while at the same time consumption demand and government demand holds up. Given that Obama may nominate Yellen as the next Fed's vice chairman and that thus Bernanke will get more support to his low interest rate policy, one can be as sure as one can be sure regarding economic matters that the US is running at full speed into hyperinflation.

Thursday, March 11, 2010

An "Eurasian" common currency in the making

Igor Shuvalov, First Deputy Prime Minister in Mr Putin’s Government, suggested that Russia may abolish the rouble and create a common currency with Kazakhstan and Belarus.

The three states have already established a customs union and plan to form a single economic market by 2012. Mr Shuvalov said that he would not rule a currency union as “the next logical step”, adding that it would be modelled on the euro.

Full text

Comment: The race is on for where will be the next empire: China and South-East Asia or Eurasia? The European Union? Or maybe an American renaissance? Nobody knows because empires are built much more by accident than by design.

The three states have already established a customs union and plan to form a single economic market by 2012. Mr Shuvalov said that he would not rule a currency union as “the next logical step”, adding that it would be modelled on the euro.

Full text

Comment: The race is on for where will be the next empire: China and South-East Asia or Eurasia? The European Union? Or maybe an American renaissance? Nobody knows because empires are built much more by accident than by design.

Wednesday, March 10, 2010

The incredible debt machine

WASHINGTON (AP) -- The government ran up the largest monthly deficit in history in February, keeping the flood of red ink on track to top last year's record for the full year.

WASHINGTON (AP) -- The government ran up the largest monthly deficit in history in February, keeping the flood of red ink on track to top last year's record for the full year.The Treasury Department said Wednesday that the February deficit totaled $220.9 billion, 14 percent higher than the previous record set in February of last year.

The deficit through the first five months of this budget year totals $651.6 billion, 10.5 percent higher than a year ago.

The Obama administration is projecting that the deficit for the 2010 budget year will hit an all-time high of $1.56 trillion, surpassing last year's $1.4 trillion total. The administration is forecasting that the deficit will remain above $1 trillion in 2011, giving the country thrree straight years of $1 trillion-plus deficits...

Full text

Comment: OK, let them have their super-Keynesian experiment. When it will fail, and most likely it will fail, the consequences will be devastating. There's no comfort in the truth that when empires crumble it is not only the little man that gets buried under its rubble.

Tuesday, March 9, 2010

EU, euro and the rest

"... Today's European Union, with its deep integration spanning a variety of policy arenas long thought to be the sole purview of sovereign nations, is a surprising and anomalous political creature. Neither simply an intergovernmental organization nor a full-fledged nation-state, it has resisted simple categorization -- and has repeatedly defied the predictions of scholars and pundits..."

Kathleen R. McNamara in Foreign Affairs

http://www.foreignaffairs.com/features/readinglists/what-to-read-on-the-european-union

Comment: There are few areas in international political economy where false analyses, wrong predictions, disastrous recommendations, and absurd claims are so common as it has been the case with the European Union and the euro.

Kathleen R. McNamara in Foreign Affairs

http://www.foreignaffairs.com/features/readinglists/what-to-read-on-the-european-union

Comment: There are few areas in international political economy where false analyses, wrong predictions, disastrous recommendations, and absurd claims are so common as it has been the case with the European Union and the euro.

US banking system insolvent, Roubini says

“The United States banking system is effectively insolvent,” Mr. Roubini said...

Edward L. Yingling, president of the American Bankers Association, called claims of technical insolvency “speculation by people who have no specific knowledge of bank assets.” ...

Read more about the controversy and learn that nobody knows.

Edward L. Yingling, president of the American Bankers Association, called claims of technical insolvency “speculation by people who have no specific knowledge of bank assets.” ...

Read more about the controversy and learn that nobody knows.

Monday, March 8, 2010

King's case for deflation

Stephen King of HSBC writes: "... I do not think that the biggest influence on prices will be supply-side bottlenecks – notwithstanding the evidence of supply problems on either side of the Atlantic. We are living in a world of deleveraging and debt repayment: it might be a world that damages supply potential but, for me, it's a world which ultimately is deflationary. That, I think, will be the big surprise in the years ahead..."

Read full text

Comment: King provides a well-spun argument and makes his point very clear that rather than inflation, deflation may lie ahead. He bases his argument on asset valuations and debt consolidation in contrast to the supply-side model of the stagflationists. Unfortunately, King leaves out the joker in the game: government. Of course, when the economy will shrink and asset prices fall, the strife for debt consolidation will increase, yes, but this holds only for the private sector. The public sector, however, will increase ever more its expenditures, as it is already being done. While the productive part of the economy is shrinking and less goods and services are being produced, active spending on the net is increasing through government. More demand hits less supply. The consequence is stagflation.

Read full text

Comment: King provides a well-spun argument and makes his point very clear that rather than inflation, deflation may lie ahead. He bases his argument on asset valuations and debt consolidation in contrast to the supply-side model of the stagflationists. Unfortunately, King leaves out the joker in the game: government. Of course, when the economy will shrink and asset prices fall, the strife for debt consolidation will increase, yes, but this holds only for the private sector. The public sector, however, will increase ever more its expenditures, as it is already being done. While the productive part of the economy is shrinking and less goods and services are being produced, active spending on the net is increasing through government. More demand hits less supply. The consequence is stagflation.

Sunday, March 7, 2010

Getting serious about risk - finally

Special report by The Economist on financial risk

The gods strike back

Financial risk got ahead of the world’s ability to manage it.

Read more

Comment: Modern financial theory is a system of belief dressed in math. This theory has little substance; it is mainly an exercise in formalism. Business schools and economics departments have produced an avalanche of graduates who may be "smart" in a narrow sense but who lack the power of reason and sound judgement.

The gods strike back

Financial risk got ahead of the world’s ability to manage it.

Read more

Comment: Modern financial theory is a system of belief dressed in math. This theory has little substance; it is mainly an exercise in formalism. Business schools and economics departments have produced an avalanche of graduates who may be "smart" in a narrow sense but who lack the power of reason and sound judgement.

Saturday, March 6, 2010

Myths of the Great Depression

David Friedman snubs David Frum with some basic facts:

Friedman writes: "... David Frum, a former speech writer for George W. Bush and a fellow at the conservative American Enterprise Institute, responded by blaming the gold standard for the Great Depression. "Threatened with the exhaustion of its gold supply," Frum said, "the government felt it had no choice: It had to close the budget deficit. So, in the throes of a severe downturn, the U.S. government did exactly the opposite of what economists would otherwise advise: It cut spending and raised taxes — capsizing the economy even deeper into depression."

But as the table below shows, that version of the history of the Great Depression is entirely fictional.

During every year of Hoover's administration, from 1929 to 1932, federal expenditure increased.

By 1932, expenditure had gone up 50% measured in dollars, almost doubled measured in purchasing power, tripled measured as a fraction of national income..." Read full text

Read full text

Comment: Some myths, so it seems, never die. It is absolutely amazing how anybody can still hold on to the Rooseveltian fairy tale that Hoover's failure was his "do-nothing-policy" when in fact it was the opposite. Hoover was as much an interventionist when in office as Roosevelt. Both presidents must bear the blame to have pushed the world into the abyss of depression with world war as its consequence.

There is this saying that who doesn't know history is condemned to repeat it. This may well be the case with the current economic and financial crisis. The myth is already in the making that George W. Bush was a president of laissez-faire and it was finally Obama who "got us out of the depression" -- although (just like with Roosevelt), Obama's contribution most probably will be to prolong and deepen the crisis.

Besides Frum, it is also Paul Krugman who is in urgent need to expand his education by reading the Murray Rothbard classic America's Great Depression

Friedman writes: "... David Frum, a former speech writer for George W. Bush and a fellow at the conservative American Enterprise Institute, responded by blaming the gold standard for the Great Depression. "Threatened with the exhaustion of its gold supply," Frum said, "the government felt it had no choice: It had to close the budget deficit. So, in the throes of a severe downturn, the U.S. government did exactly the opposite of what economists would otherwise advise: It cut spending and raised taxes — capsizing the economy even deeper into depression."

But as the table below shows, that version of the history of the Great Depression is entirely fictional.

During every year of Hoover's administration, from 1929 to 1932, federal expenditure increased.

By 1932, expenditure had gone up 50% measured in dollars, almost doubled measured in purchasing power, tripled measured as a fraction of national income..."

Read full text

Read full textComment: Some myths, so it seems, never die. It is absolutely amazing how anybody can still hold on to the Rooseveltian fairy tale that Hoover's failure was his "do-nothing-policy" when in fact it was the opposite. Hoover was as much an interventionist when in office as Roosevelt. Both presidents must bear the blame to have pushed the world into the abyss of depression with world war as its consequence.

There is this saying that who doesn't know history is condemned to repeat it. This may well be the case with the current economic and financial crisis. The myth is already in the making that George W. Bush was a president of laissez-faire and it was finally Obama who "got us out of the depression" -- although (just like with Roosevelt), Obama's contribution most probably will be to prolong and deepen the crisis.

Besides Frum, it is also Paul Krugman who is in urgent need to expand his education by reading the Murray Rothbard classic America's Great Depression

Fooled by the numbers

Jim Quinn writes: "... To date, the Federal Reserve has printed well over a trillion dollars in an attempt to evade a deflationary collapse, including a $700 billion bank bailout and a $787 billion stimulus package. And then there was $3 billion wasted on Cash for Clunkers ($24,000 per vehicle), $28 billion squandered on the $8,500 homebuyer tax credit, and an artificial suppressing of interest rates to 0% with $300 billion of mortgage-backed securities. And all we’ve gotten is a 2.8% increase in GDP? Based on government-reported figures, our GDP has not fallen anywhere near the amount it declined during the Great Depression. But if you believe government-reported figures, I have an indoor ski resort in Dubai I’d like to sell you. The fact is the government has systematically underreported inflation since the early 1980s. By doing so, it has systematically overstated GDP. Economist John Williams presents the true GDP growth in the following chart. As you can see, the U.S. has effectively been in a recession since 2001. Using these figures, it is probable that we are in the midst of a second Great Depression..."

Full text

Backgrounders:

What's Wrong With Economic Growth?

The Illusion of Hedonics

Full text

Backgrounders:

What's Wrong With Economic Growth?

The Illusion of Hedonics

Friday, March 5, 2010

The bailout of Greece takes shape

March 5 (Bloomberg) -- European Union nations are working on a contingency rescue plan for Greece to be funded by its member governments, according to two people briefed yesterday in Berlin by an EU official.

The briefing, coming the day Greece sold 5 billion euros ($6.8 billion) of bonds, underscores the balancing act facing European officials as they prod Greek Prime Minister George Papandreou to cut the biggest EU budget deficit without their committing funds. Papandreou, who today began meetings in Luxembourg, Berlin, Paris and Washington, has to contend with protests at home against his tax increases and spending cuts.

Read more

Comment: The "euros", knowingly or not, are constructing another project in their long history of constructing projects. Of course, in the end they will fail also with this new project, just like they did with all of their past projects. Nevertheless, as to their latest project, a European "Union" and a "common" currency, we are only at the beginning of a much greater project. Across the whole political spectrum (exept of some pissers) there is a consensus that the euro show must go on.

The EU and the euro are history in the making -- and they are history in the making on a big scale.

Quite often is said that the EU and the euro won't work because of the lack of political union. These commentators get it all wrong: an ever closer EU and the common currency are the means in order to bring about a political union. This way each crisis, like the present one, will not bring a break-up of the EU but on the contrary, crisis like the current Greek crisis will serve as stepping stones for an ever deeper union. At the end of the current crisis, we'll see a stronger union fortalized by the creation of new institutions such as, for example, a kind of European Monetary Fund (EMF).

The briefing, coming the day Greece sold 5 billion euros ($6.8 billion) of bonds, underscores the balancing act facing European officials as they prod Greek Prime Minister George Papandreou to cut the biggest EU budget deficit without their committing funds. Papandreou, who today began meetings in Luxembourg, Berlin, Paris and Washington, has to contend with protests at home against his tax increases and spending cuts.

Read more

Comment: The "euros", knowingly or not, are constructing another project in their long history of constructing projects. Of course, in the end they will fail also with this new project, just like they did with all of their past projects. Nevertheless, as to their latest project, a European "Union" and a "common" currency, we are only at the beginning of a much greater project. Across the whole political spectrum (exept of some pissers) there is a consensus that the euro show must go on.

The EU and the euro are history in the making -- and they are history in the making on a big scale.

Quite often is said that the EU and the euro won't work because of the lack of political union. These commentators get it all wrong: an ever closer EU and the common currency are the means in order to bring about a political union. This way each crisis, like the present one, will not bring a break-up of the EU but on the contrary, crisis like the current Greek crisis will serve as stepping stones for an ever deeper union. At the end of the current crisis, we'll see a stronger union fortalized by the creation of new institutions such as, for example, a kind of European Monetary Fund (EMF).

Russia on its knees

Russia’s Gold Deficit Shows Us What’s Wrong

by Celestine Bohlen

March 5 (Bloomberg) -- Russia is in a funk. Its performance at the Winter Olympics in Vancouver was its worst ever, and its economy suffered more last year than any other nation in the Group of 20.

This is no coincidence, as the old Communist newspaper Pravda used to say. These failures are linked, and they have to do with a political system that has sucked the air out of the country. State companies control much of the economy, a single party rules the airwaves, and an overbearing, corrupt bureaucracy twists laws and stifles initiative.

None of this is good for business and, as it turns out, it isn’t good for sport. If Russia wants to go for gold it will have to shed a system that operates from the top down...

Read more

Comment: Communism has not only destroyed the Russian economy, even worse, the lasting legacy of Communism is the destruction of the Russian soul. The first step in order to dispel the ghosts of the past is the full confrontation with the past evils. It is up for the Western World War II allies of the Soviet Union to help Russia now in this process. The first step would be to admit that the West's war alliance with Stalin was a band with the devil.

by Celestine Bohlen

March 5 (Bloomberg) -- Russia is in a funk. Its performance at the Winter Olympics in Vancouver was its worst ever, and its economy suffered more last year than any other nation in the Group of 20.

This is no coincidence, as the old Communist newspaper Pravda used to say. These failures are linked, and they have to do with a political system that has sucked the air out of the country. State companies control much of the economy, a single party rules the airwaves, and an overbearing, corrupt bureaucracy twists laws and stifles initiative.

None of this is good for business and, as it turns out, it isn’t good for sport. If Russia wants to go for gold it will have to shed a system that operates from the top down...

Read more

Comment: Communism has not only destroyed the Russian economy, even worse, the lasting legacy of Communism is the destruction of the Russian soul. The first step in order to dispel the ghosts of the past is the full confrontation with the past evils. It is up for the Western World War II allies of the Soviet Union to help Russia now in this process. The first step would be to admit that the West's war alliance with Stalin was a band with the devil.

Wednesday, March 3, 2010

End of the dollar rally

The German weekly has the "Super dollar" on its cover. If there is a contrarian indicator, this certainly is one.

We may expect the dollar rally to falter within the next couple of days.

We may expect the dollar rally to falter within the next couple of days.

Competition for rating agencies

Plans are being discussed to set up a proper European rating system in as a counterpart to the US rating agencies. European Union officials and euro central bankers are mad at S&P, Moody's and Fitch because of the extreme downgrading of Greece by these agencies. European officials feel that the downgrading was not justified.

Irrespective of the current concrete situation, it is high time that the US rating agencies get competitors. The US rating agencies have performed extremely poor over the past years, well, decades. In fact, in may cases their "rating" was a bad joke.

Irrespective of the current concrete situation, it is high time that the US rating agencies get competitors. The US rating agencies have performed extremely poor over the past years, well, decades. In fact, in may cases their "rating" was a bad joke.

Tuesday, March 2, 2010

No news to the readers of this blog

March 3 (Bloomberg) -- The euro may strengthen for a second day with Greece expected to unveil new measures to cut the European Union’s largest budget deficit, increasing speculation that a solution to its debt crisis may be nearing...

Full text

Full text

Greece ready for budget cuts

March 2 (Bloomberg) -- The Greek government will announce as much as 4.8 billion euros ($6.5 billion) of additional deficit cuts tomorrow, bowing to pressure from the European Union and investors to do more to tame the region’s biggest shortfall, a person familiar with the plan said.

The new measures will include higher tobacco, alcohol and sales taxes and deeper cuts in public workers’ bonus payments, said the person, who declined to be identified because the details aren’t public. Greek bonds advanced for a third day today on the prospect that the deficit measures might ease opposition to EU aid for Greece....

Full text

Comment: Greece has so much slack in its public sector that a cut of $ 6.5 billion of public expenditure is not so painful as it may appear. Like it is healthy for an obese person to slim, the Greek budget cut will strengthen the Greek economy and contribute to making its political life more sound. Even a cut of $ 10 billion wouldn't put the Greek into the poorhouse.

Comment: Greece has so much slack in its public sector that a cut of $ 6.5 billion of public expenditure is not so painful as it may appear. Like it is healthy for an obese person to slim, the Greek budget cut will strengthen the Greek economy and contribute to making its political life more sound. Even a cut of $ 10 billion wouldn't put the Greek into the poorhouse.

Monday, March 1, 2010

Assault on the euro will fail

Over the weekend more news and rumors came out that the euro countries are determined to ward off any assault on the common currency. Some top euro decision maker regard the crisis as a great opportunity to re-establish the "primacy of politics". Those who follow the Soros call well may get a bloody nose in the venture to attack the euro. The next financial market drama is not a Greek tragedy as many expect but the unwinding of the massive short positions against the euro.

Subscribe to:

Posts (Atom)