Bill Bonner calls for the arms:

"Vive la revolution!

But the poor protestors are just victims of history. When the US embraced its empire it condemned its middle classes. Why? Because that’s how empires work. They bring in cheap goods — and sometimes money itself — from outside. Whether they are taken as booty or traded for the imperial currency, the effect is about the same; they undermine local industries and local wages.

Ancient Rome imported wheat from Egypt, by the boatload, and gave it to citizens (an early form of food stamps). Result: the price of wheat collapsed. Small farmers couldn’t compete with free wheat. They couldn’t earn a living.

The Romans also brought in slaves. Rich, politically-connected Romans took over the small farms, consolidated them into big plantations, and ran them with slave labor. Again, the local labor was out of luck.

Things got so bad for the small farmers that they sold their children into slavery…and then, themselves. Then, in alarm, an edict prohibited Roman farmers from selling themselves into slavery. They were required to remain on their farms…and at work.

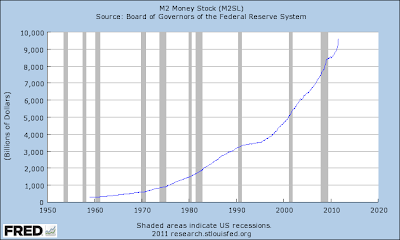

Spain ran a very different, short-lived empire in the 16th century. It conquered New World civilizations and imported gold and silver on a colossal scale. It was as if they were printing money! This easy money made the Spaniards rich. They used it like America uses her dollars — to buy things from overseas. Pretty soon, the Spanish neglected their own manufactures and their own farming. Prices rose. Spain’s nascent middle class was smothered in the crib.

Are things so different now? The rich get rich. The middle classes get poorer; they have to compete with imperial plunder…riches coming from Asia, bought with dollars that were never earned…and never will be redeemed.

America’s middle classes were happy to sell their own children into perpetual debt servitude. The kids face obligations 5 to 15 times as great as annual output. Unless they revolt, they will have to work their entire lives to pay for their parents’ excesses.

But what will they do when future generations can take no more? They cannot sell themselves into slavery. They’ve already done so. Most face a lifetime of student debt, mortgage debt, and medical debt (aka Medicaid and Medicare), already.

What can they do? Join the revolution!